Why is delivery important

Delivery is popular around the world in a range of categories, but nowhere is it as much a part of the chained fast food model as in key emerging markets in Asia Pacific, Latin America and the Middle East. In both of the former regions, home delivery value as a percent of total fast food value climbs as high as 5%, as compared to fast food hub North America, where it’s less than 1% despite a much larger overall category.

Delivery service in emerging markets allows leading chains to reach the widest number of potential consumers unhindered by time or mobility constraints, as evidenced by a slogan McDonald’s once used in Asia: “If you can’t come to us, we’ll come to you.” However, as leading fast food chains come to rely more heavily on delivery in emerging markets, they’re also coming to see it as a potential growth driver in other world regions. With US$8.5 billion in total fast food delivery value in Asia Pacific alone, the potential for the service in other markets could be huge.

What’s their secret?

This opportunity can’t be discussed without first answering a basic question: Why is fast food delivery so popular in some markets and nearly unheard of in others? Fast food chains are popular—albeit at varying degrees—in every major world region, and similar players around the world compete on the basis of high-quality food, low prices, speed of service and easy accessibility. Only in key emerging markets, however, has delivery become a major component of that convenience-based positioning.

Convenience: Delivery service is more widespread component of general retail culture in some countries, especially those in Asia Pacific. In China and Japan, delivery is popular in all manner of foodservice and retail outlets, including independent restaurants, convenience stores, even hotels, and urban consumers are used to having most products within deliverable reach. For example 7-Eleven’s meal delivery service “7 Meal,” which delivers healthy bento box meals that can be ordered in stores, by phone, by fax or online, had US$98 million (¥10 billion) in sales last year.

Why is delivery important

While Japan is far from “emerging”, the local popularity of delivery is a testament to region-wide lifestyle trends that are also apparent in surrounding markets.

Given this existing demand, fast food chains are well-positioned to compete with other smaller players for consumer loyalty. Their resources allow them to invest in scooters that can speed through congested streets and equipment that keeps food hot and fresh during transit. KFC is some markets, delivers meals in boxes equipped with portable heating units and vents that keep fried items crisp. They have also invest in services such as centralized online ordering hubs that ultimately improve efficiency and keep delivery fees lower than their competitors’. This price-point issue is key, as well: As fast food brands often compete at higher relative price rungs in emerging markets than they do in those that are more developed, additional delivery fees seem more reasonable in comparison to one’s total cost per meal. In the US, for example, an additional delivery fee and tip could result in the near doubling of one’s cost.

Upmarket positioning: Another factor in play is the upmarket positioning such fast food brands enjoy in Latin America and Asia Pacific as compared with their domestic market. In many emerging markets, chained fast food is perceived as a high-quality alternative to inexpensive street food and less regulated independents, and thus is popular with a more affluent segment of the population. As higher-income groups such as professionals are more likely to be able to handle the added costs of delivery service, fast food in these markets is more readily positioned to appeal to this particular type of demand.

Mobility: Mobility is also a concern in some areas of these regions, where traffic is often a hurdle and commutes to and from work are already very long. For example, a 2010 study conducted by IBM cited Mexico City’s commute as one of the worst in the world, with average commutes of nearly two hours one-way. In these cases, many consumers take advantage of delivery service in order to stay off the roads. The service is also popular in markets where the average household doesn’t necessarily own a car, motorcycle or even a bicycle. For consumers who rely on public transportation, delivery can simplify an otherwise time-consuming errand.

Why is delivery important

Security Likewise, security can cause a boost in delivery demand for similar reasons, as consumers look to avoid venturing out of the home. Mexico again represents a particularly extreme case, as drug-related violence continue to plague citizens in certain regions. Major cities in Mexico have seen increases in delivery demand in recent years as a result of both factors, but other markets have shown similar trends. Egypt saw an 8% increase in 2011 foodservice delivery value during the height of the Arab Spring, and that increase came on the back of an already well-ingrained local fast food delivery culture. McDonald’s began offering delivery in Egypt in 1994, and in 2011 local executives reported that 30% of local sales came from delivery orders.

Delivery is local trend with global potential

Now that delivery service has been confirmed as a major revenue driver in key emerging markets, it is only expected to become more central to the local positioning of major chains. Half of new KFC outlets opening in China now feature delivery service according to the company, and McDonald’s is reportedly adding delivery to many new outlet openings in Asia Pacific and the Middle East. Even more intriguing is the fact that these chains now also appear to be flirting with the idea of offering delivery service in mature markets as well. Burger King, has jumped on the delivery bandwagon by offering the ‘BK Delivers’ service in select markets around the country, including New York City, Miami, Los Angeles, and other major cities. McDonald’s discussed the hypothetical potential of delivery service in the US in an April, 2013 interview with CNBC.

It remains to be seen whether this service could gain traction on any significant scale in the US, and the factors highlighted above are not all in play in more mature markets like the US or Western Europe. However, emerging and mature markets often have more demand drivers in common than we may think, especially in the kind of major metropolitan areas where fast food delivery is thriving.

Why is delivery important

Either way, the mere idea of fast food delivery expansion lends some interesting insight as to the future evolution of global fast food. Perhaps the main story here is less about a service that’s finding success in a few key markets due to unique conditions, and more about one that is rapidly becoming a major part of the global fast food landscape. As category leaders begin experimenting with the process and testing its limits both at home and abroad, we may soon have the chance to find out.

The above article gives us many reasons, why we should seriously consider delivery as a new and important channel of business. Some of the top reasons which are relevant to us are given below:

- Need of the hour – rapidly becoming major part of the global fast food landscape

- Customers are voicing the need – busy schedules, requirement for convenience creating the need for delivery

- Competition is striding fast – McDonalds, Burger King and other major fast food players exploring delivery in a big way in emerging markets and also testing in matured markets

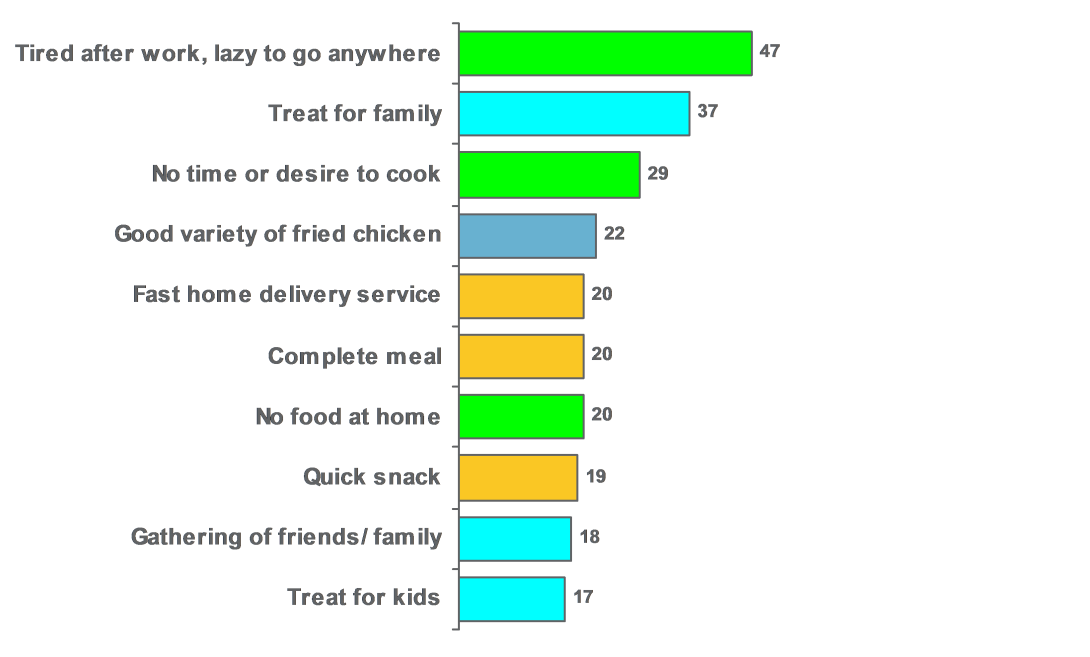

An interesting study conducted in Singapore shows that “Tiredness/laziness and convenience” emerge as key drivers followed by treat (family/kids)

Source: Nielsen Survey for KFC and PH Singapore

Why is delivery important

The main (functional) benefit of home delivery is Convenience:

- Food gets delivered right to the doorstep and one can still continue with whatever errands one is busy with at home - Making use of time to do housework, catch favourite show on TV, mingle with friends who are over for gathering

Why is delivery important

- Save time and hassle of travelling out to eat or buying food back - Avoid wasting time changing, going out, looking for car park, queuing to get food

- Save time and effort needed to prepare a meal and wash up after - No need to “crack your head” or think too much about what to cook

- No fuss and meets expectations of a spontaneous decision to eat at home - Easy to order and able to enjoy a meal in the comfort of own home

Given the above need state of consumers, there is a desperate need, convincing proposition and huge business opportunity waiting to be capitalized.

To understand more about how to go about establishing the need of delivery and understanding consumer trends, refer to the survey done by KFC & PH Singapore in the link below:

KFC & PH Singapore - Establishing Delivery Need Establishing Delivery Needs

We should be mindful that “If we don’t deliver, someone else will”. So we must explore possibilities of delivery in our market. In order to provide a great delivery experience, we should meet our customer’s basic needs as follows:

- Easy to order

- Delivered fast and on time

- Hot and good quality food

- Complete and accurate

Why is delivery important

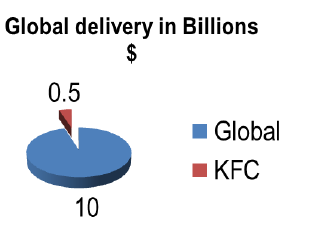

And if we get it right….it’s a big pie!

- Global spend on QSR delivery tops $10 billion!

- Unlocking potential….delivery and catering go where restaurants can’t!

- Delivery customers tend to order more frequently than dine-in customers and spend more!

- Over 40 countries offer KFC Delivery, with many generating over 20% of total sales from Delivery

- Average delivery transaction = $12 vs Average dine in transaction at $5

- Frequency of delivery pushes up average frequency - 4 of top 10 frequency countries are in MENA with market mix of 35% delivery and 3-4% catering mix

- At 3% of mix delivery and catering could equate to +$1000 wpsa or +$50k per annum X 20000 KFCs = $1 Billion

- Catering Customer is a valuable customer (US data 2013)

Why is delivery important

Current KFC Customer |

KFC Catering customer |

Orders 6 times per year, buys a 2 pc box meal |

Orders 3 times per year buys a meal for 15 people |

$6 per order X 6 orders per year |

$80 per order X 3 orders per year |

$36 annual spend |

$240 annual spend |

Key steps to launch delivery

Step 1: Develop the Customer Proposition

Fully understand the customers’ needs and drives to use KFC for delivery.

e.g A recent survey by Consumer Edge Insight shows that delivery appeals to certain demographics more than others, including consumers in the 18–34 age range, those individuals who are single and living alone, and those who have lower incomes.

Define what is KFC proposition in your market e.g PH proposition is “Hot & On-time”. Then prove the need! Brand it accordingly.

Step 2: Define the business opportunity

Finesse the financial modelling for start-up and evolution markets. e.g Burger chain Fatburger considers each day part separately to determine the feasibility and profitability of delivery in each market. At some Fatburger locations, delivery service is only offered for specific day parts based on the customer demand in the area. “In New York City, there may be a late-night demand for delivery, while in other areas with a lot of office complexes; there may be a higher demand for lunch delivery.

They also determine which stores will offer delivery based on the customer base’s characteristics and the surrounding area. If the store is located in a dense or urban area or has a very large lunch crowd, they plan to offer direct delivery from the store. In less-dense areas, they use a third-party delivery service, which covers many restaurants.

Key steps to launch delivery

Step 3: Execute….Excellently!!

Delivery isn’t something, we should roll out to all locations at one go, it should first be implemented and perfected in select stores and markets. Sometimes even the most basic things like product quality can wrong. e.g: we should not have the type of product that is undeliverable or that you sacrifice the quality of the product. If we are delivering a product compromised in taste or look, then our customer satisfaction will be lower. Add-ons like hot boxes or freezers in delivery vehicles can help guarantee that the quality of the food is not sacrificed by delivery.

Fatburger designed specific packaging for delivery, using a vented container to prevent French fries from becoming soggy due to steam. In addition, each burger is wrapped in a cardboard sleeve to help keep the shape of the burger so that it’s fresh, visually appealing, and appetizing when the customers open up their burgers. Milkshakes are delivered in a freezer box, and delivery drivers carry whipped cream on the bike and put the whipped cream on when they arrive at the customer’s location to keep it fresh. KFC in some markets uses similar packaging material that maintains quality of the product until it reaches the customer.

When incorporating delivery into the business, integrating the process with store systems can help make it as efficient as possible. At Capriotti’s, the use of software that connects to its point-of-sale system helps effectively deliver the address, location, and special instructions to the driver, as well as track delivery status.

From a branding stand-point, think very closely about both the transportation being used and the people being hired to make the deliveries. Are the cars/vehicles clean, well signed or even graphically wrapped. If they are not, than a disconnect can occur between the brand promise and its extension. Same for the delivery person - do they match the brands culture? They should, as repeat customers will win the day and move this trend beyond a simple reinvention of the delivery guy. It is all about seamless delivery of your product to customers.

Source : Extracts from Euromonitor & ConsumerEdge Insight

Key steps to launch delivery

To build further know-how, I have attached below how markets like China and Taiwan have worked to establish the strategy for delivery, please refer to the following links for best practices from different markets:

- KFC China Delivery Strategy Click here to download

- KFC Taiwan Delivery Strategy Click here to download

Customer is why!!

Customers tell us when we don’t follow the standards:

Customer is why!!

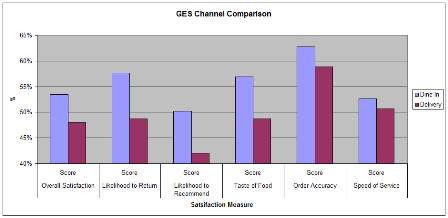

Conclusion & Watch-outs:

- Delivery can be operationally more demanding than other channels

- GES gives the perfect opportunity to acknowledge where gaps arise

- Particular issue can arise around taste of food – packaging, hotness, moisture and presentation

- As delivery can be more of an occasion (sharing, friends family) and therefore the customer can be less forgiving. This can show itself in ;

- Less likely to return

- Less likely to be completely satisfied

And customers also tell us when we follow the right standards, by coming back for more.

There is a noticeable improvement in results in the newly launched Amrest delivery stores, validating the right processes in place and executed flawlessly. In particular taste of food is looking strong following the work conducted with Amrest

We want our customers to say… “I always get my food , hot, fresh and within the promised time. KFC really cares.”